Week of October 3, 2025

The Week at a Glance:

Equities Rose Despite the Government Shutdown: Major indices were up an average of 1.2% in spite of the government shutdown and the delay in releasing September jobs report

The Art of the Pfizer Deal: Pfizer struck a deal with the Trump administration to cut Medicaid US drug prices — offering major consumer discounts and “most-favored-nation” pricing in exchange for tariff waivers and expanded US manufacturing investments

Biopharma Is So Back (Again?): Both the NBI and NYSE Pharma Index significantly outperformed the broader market last week as the Pfizer-Trump deal sparked a rally as investors perceived it as a sign of more favorable drug-pricing deals for biopharma companies to come

The Multispecific Moment Sees a Multi-Billion Dollar Deal: Genmab announced an $8B all-cash acquisition of Merus, gaining full ownership of the biotech’s lead asset petosemtamab, a Phase 3 bispecific antibody targeting EGFR and LGR5 for head and neck cancers, to strengthen its oncology pipeline and expand its wholly owned portfolio

Read more about the market analysis and investment trends in multispecific antibodies in DNB//Back Bay’s recent white paper here

Markets Overview

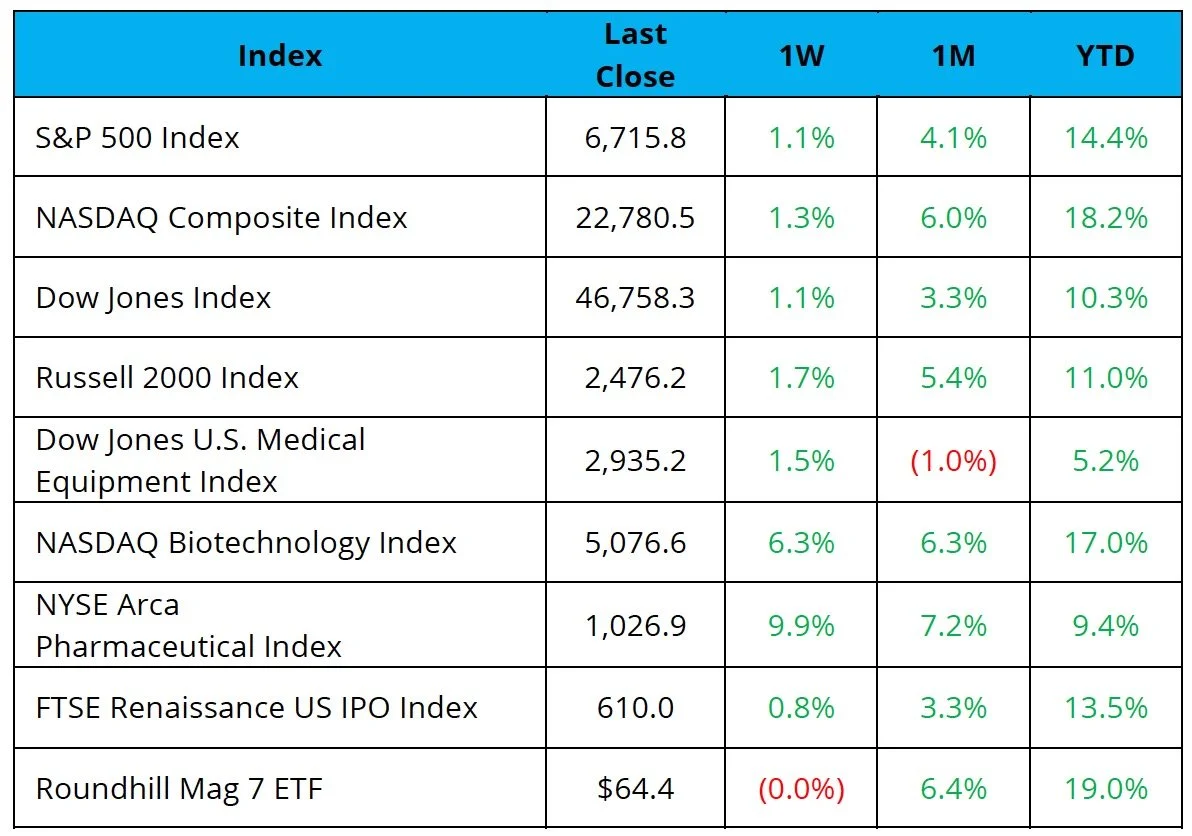

The S&P 500, Nasdaq, and the Dow rose 1.1%, 1.3%, and 1.1%, respectively

Although the Bureau of Labor Statistics’ September jobs report was delayed, ADP’s private-sector jobs data pointed to continued labor market softening, reinforcing expectations of a second rate cut

Healthcare indices outperformed the broader market last week as the Pfizer-Trump deal gave hope that more favorable deals around drug pricing would be coming soon. The NYSE Pharma Index and the NBI were up 9.9% and 6.3%, respectively

Notable changes in share price:

Enanta Pharmaceuticals (NASDAQ: ENTA): Shares rose 44.7% after the Company reported positive Phase 2b results in RSV, demonstrating strong efficacy in adults with acute infection who are at high risk of complications

MoonLake Immunotherapeutics (NASDAQ: MLTX): Shares fell 86.4% after the Company reported disappointing results from its Phase 3 trial in hidradenitis suppurativa

KALA BIO (NASDAQ: KALA): Shares fell 89.4% after the Company announced that its Phase 2b trial for persistent corneal epithelial defect failed to meet all primary and secondary endpoints

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed IPOs last week

One company filed an S-1 last week:

Ottobock SE & Co. KGaA intends to raise ~$760.0M to advance its portfolio of prosthetics, orthotics, and mobility technologies supporting people with limited mobility worldwide. The IPO would continue the major trend we have seen this year of commercial-stage MedTech companies

Of 20 companies in the queue, only two intend to raise more than $30.0M in proceeds

IPOs that have priced this year have delivered a median gain of 21.7%, with ~65% of newly public companies trading above their offer price

Source: CapIQ

Follow-On Offering Markets:

There were 12 follow-on equity offerings last week totaling $710.2M, including:

Hansa Biopharma (STO: HNSA) raised $71.3M to support BLA filing and US commercial launch preparations for imlifidase, a first-in-class IgG antibody-cleaving enzyme therapy for desensitization kidney transplantation. DNB Carnegie acted as a joint global coordinator and joint bookrunner.

Ocular Therapeutix (NASDAQ: OCUL) raised $475.0M to fund clinical development of AXPAXLI (axitinib hydrogel injection), including an open-label extension study for wet AMD and Phase 3 trials for non-proliferative diabetic retinopathy

Palisade Bio (NASDAQ: PALI) raised $138.0M to advance clinical development of PALI-2108, a PDE4 B/D inhibitor in Phase 1b for ulcerative colitis and fibrostenotic Crohn’s disease, and to support additional preclinical programs across inflammatory indications

Enanta Pharmaceuticals (NASDAQ: ENTA) raised $74.8M to advance clinical development of zelicapavir, a Phase 2b oral antiviral targeting respiratory syncytial virus (RSV), as well as fund additional early-stage immunology programs

Source: Biomedtracker

PIPE/RDO Markets:

There were six PIPE/RDO deals last week raising an aggregate $42.9M

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available and focuses on the rapid growth of bispecific or multi-specific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.