Biopharma Companies Don’t Need to Be Public to Survive

by Vasilios Kofitsas and Susmita Roy, Back Bay Life Science Advisors Investment Banking

Within the C-suites and board rooms of private biopharma companies, R&D and the current state of the public and private markets play a vital role in enabling growth and progress.

In booming markets (before the recent slowdown), private companies had multiple options for funding, whether it was the private route via the venture capital community or public markets through traditional IPOs and SPACs. In fact, 2021 and Q1 2022 displayed record-breaking numbers of private financings and capital brought into the space. Public market fundraising also broke records in 1H 2021, but witnessed an ostensibly rapid decline in investor sentiment in the second half of the year with the declining indices. As the public market continues its slowdown, private companies, who are constantly in need of capital, are naturally concerned with the impact to funding initiatives--availability of capital and the right funding sources (private vs IPO).

Private funding markets remain healthy

The strong run of private financings has continued in Q1 2022, with over 193 private financings rounds completed in the US, bringing in over $10B in financing to the healthcare space.

These private financings accounted for ~46% of biopharma capital raised in Q1 2022, while public raises accounted for ~34% of all capital (see Figure 1).[i] The first quarter of 2022 was also the first time over $10B in private financing came into the market in a single quarter, a steep increase from the average of ~$4.2B seen in Q1 2017-2020 (see Figure 2).[ii]

It is not surprising that the amount of capital deployed is in line with the recent fundraising initiatives from the VC community. Firms such as Atlas Venture, Canaan and Frazier raised over $2.2B in new biotech-focused funds in March.[iii] Most recently, Carlyle acquired Abingworth, expanding their traditional private equity platform into early-to-late stage biotech.

Figure 1: Biopharma Money Raised in 2022

Figure 2: Quarterly Biopharma VC Rounds

IPO window is closed for the time being

In comparison, the NASDAQ Biotechnology Index continues to demonstrate a below-average performance compared to the overall stock market, underperforming the S&P 500 for the third year in a row. As a result, only 10 IPOs were completed [iv] in the US year to date, bringing in ~$730M into the market, with a median IPO raise of $69M and post-valuation median of $281M. This decrease in public market sentiment contrasts the strong start to 2021 in which biopharma IPOs continued to break records set in the first half of 2020. In that time, over 60 IPOs and $10B of capital were brought into public markets, and the strong start in 2021 seemingly conveyed that the strong public market sentiment observed due to COVID in 2020 (total IPOs= 76) was still on display[v] (see Figure 3). However, in the second half of the year, investor interest started to dwindle. The cause for this was correlated to early-stage and potentially low-quality issues that were swept up in the momentum of the blossoming market but failed to meet expectations. In fact, already public biopharma companies are trading at the lowest point since 2002 from an EV/cash perspective (see Figure 4)[i]. With these trends, it’s not surprising that IPOs have slowed as there is hesitation among both companies and investors to enter a turbulent market. Having said that, there is a cue of ~75 biopharma companies that are gearing for a public listing providing some optimism[vii] of an open window in the near future.

Figure 3: Biotech IPOs by Quarter

Figure 4: EV/Cash Multiples by Year for Biopharma Companies

SPACs are creative funding options but these markets are challenging

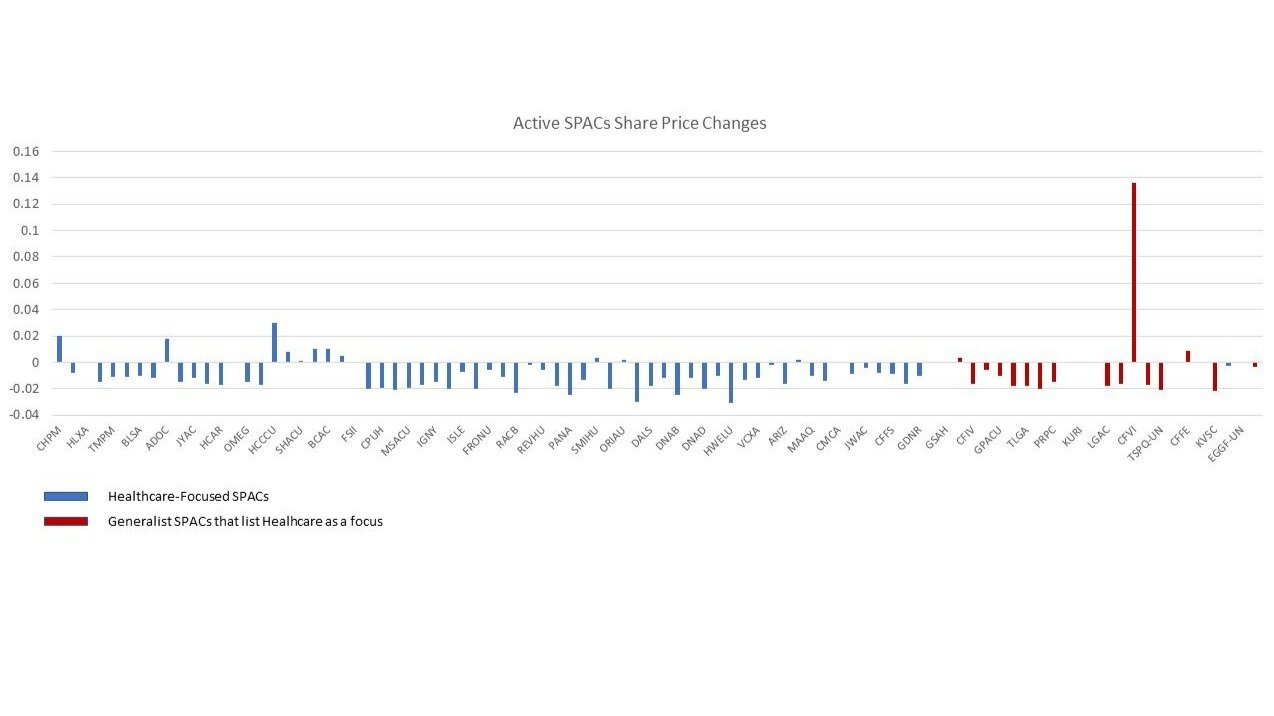

Outside of the traditional IPO market, private companies have also considered SPACs (Special Purpose Acquisition Corporations) as a way into the public market. At this time, there are ~65 healthcare-focused SPACs that are currently looking for assets/private companies to acquire, which could be a viable funding event for private companies looking to make the jump into the public market. However, there are two key data points that are creating challenges for these vehicles. First, the majority of publicly-listed healthcare SPACs are trading below IPO price (see Figure 5). Second, the post de-SPAC performance has been soft with ~50% trading below merger valuation (see Figure 6). While still too early in the public life-cycle (i.e., these companies have not been public long) to arrive at concrete conclusions, questions as to the viability of the SPAC vehicle are emerging particularly when it comes to merger valuations. Given these trends, is this the end of SPACs as an alternative for private biopharma companies? Hardly. In fact, we believe SPACs are here to stay as long as valuation expectations become rational. Merging at a high valuation makes for a nice press release, but justifying the valuation in the after-market is a different story.

Figure 5: Active SPACS Share Price Changes

*Share Price Change reflects change from IPO Share Price

Figure 6: Aftermarket Performance of SPACs that have Completed Mergers with Private Companies

Focus on optimal funding strategies . . . it’s ok to remain private

As biotech companies used 2019 to 2021 to fund development, we are in the point of the cycle where the investment is now reaping clinical results. As we advise companies on R&D and funding strategies, there are a few key points that we continue to highlight particularly in these uncertain markets:

Don’t build companies to IPO or sell. Rather, focus on the optimal path to getting the treatment to patients including indication prioritization and clinical trial designs that will enable both regulatory approval and reimbursement regardless of stage.

Focus fundraising strategies to achieve critical inflection points but also provide some runway should unforeseen circumstances cause delays, regardless of valuation. There is no worse dilution than being in the position of not having raised enough capital due to valuation concerns (which tend to be under pressure during downturns).

While there are significant benefits to being publicly-traded, don’t be in a hurry to go public. The VC community is a critical component to the funding ecosystem with the capital, expertise and risk-tolerance to enable R&D. Ultimately, they can provide the optimal pathway to liquidity.

While the industry may be shielded to a certain extent from macro-environmental factors, the biotech markets are indeed cyclical. Don’t get caught up in the “ups and downs”, but rather position the company to succeed regardless of market conditions. While windows will always open and close, there is a significant amount of smart and creative capital available to private biopharma companies.

—

[i] BioWorld Q1 Report, Apr 1, 2022

[ii] Evaluate Pharma 2020 in Review

[iii] Fierce Biotech, March 2022

[iv] Pitchbook as of Mar 31, 2022

[v] Evaluate Pharma 2020 in Review

[vi] Jefferies Q1 Biotech Report

[vii] BioPharma Drive. “Biotech Startups face ‘Trickle-down effects’ as sector’s IPO drought endures.” April 11, 2022