Exploring the US-China Biotech Boom

Written by Trent Gordon

With Contributions by Peter Bak and Anna Urrea

Introduction

As 2024 drew to a close, a surge of Chinese dealmaking led many industry watchers to wonder if a transformative shift in the biotech industry has begun—one that could profoundly impact the future of early-stage drug development.

Historically, the Chinese pharmaceutical industry has prioritized the development of generics and clinically validated targets. However, regulatory reform in the past 5-10 years has reshaped the Chinese biotech industry, incentivizing novel drug development and streamlining protocols to better align with global standards. Indeed, in 2024, China’s share of the global pipeline, as measured by volume of assets, was reported to be ~27%, up from 24% in 2023 and over six times larger than it was a decade ago.[1]

These efforts have borne fruit as 2024 saw a number of high-profile data releases from assets originated from Chinese headquartered companies. Notably, the data released by Summit Therapeutics at the World Conference on Lung Cancer in September 2024 sent Summit’s market cap soring +260%. Originated by Chinese partner Akeso, Ivonescimab is a PD-1/VEGF bispecific antibody that nearly doubled the progression-free survival (PFS) in patients with non-small cell lung cancer (NSCLC) compared to Keytruda (11.1 months vs. 5.8 months, respectively) in a trial conducted in China. On the heels of this data, other PD-1/VEGF bispecific assets developed in China were snapped up, with BioNTech spending $950M to acquire Biotheus and Merck executing a licensing deal with LaNova Medicines, securing a PD-1/VEGF bispecific for $588M upfront and up to $2.7B in milestones.

With this wave of activity closing out last year, we examine the evolving US-China biotech dealmaking landscape—exploring the structure of these deals, the key players involved, and the broader implications for the future of global drug development.

Global Landscape

From 2014 to 2019, Chinese-headquartered companies demonstrated minimal transaction activity, consistently averaging only 2-4 deals annually (Figure 1). This trend began to change during the start of the pandemic, with five deals in 2020, jumping to 17 deals in 2021. In 2021, the dealmaking floodgates opened with both Novartis and Seagen spending significant upfront cash and offering billions in milestones for rights to commercial-stage Chinese assets. Novartis paid $650M upfront and ~$1.6B in milestones for BeiGene's tislelizumab, and Seagen paid $200M upfront and $2.4B in milestones for RemeGen's disitamab. However, as the biotech markets have cooled off, China has been the only region able to maintain and expand upon its initial pandemic momentum. With cash no longer as abundant as it was in the pandemic, biotech companies have increasingly sought to in-license assets from China. This has resulted in a dramatic shift towards shopping in China for innovative assets, with a record 25 deals in 2024. Large pharma companies are also increasingly filling their pipelines with Chinese assets, as one-third of their in-licensed molecules in 2024 were from Chinese companies.[2]

FIGURE 1

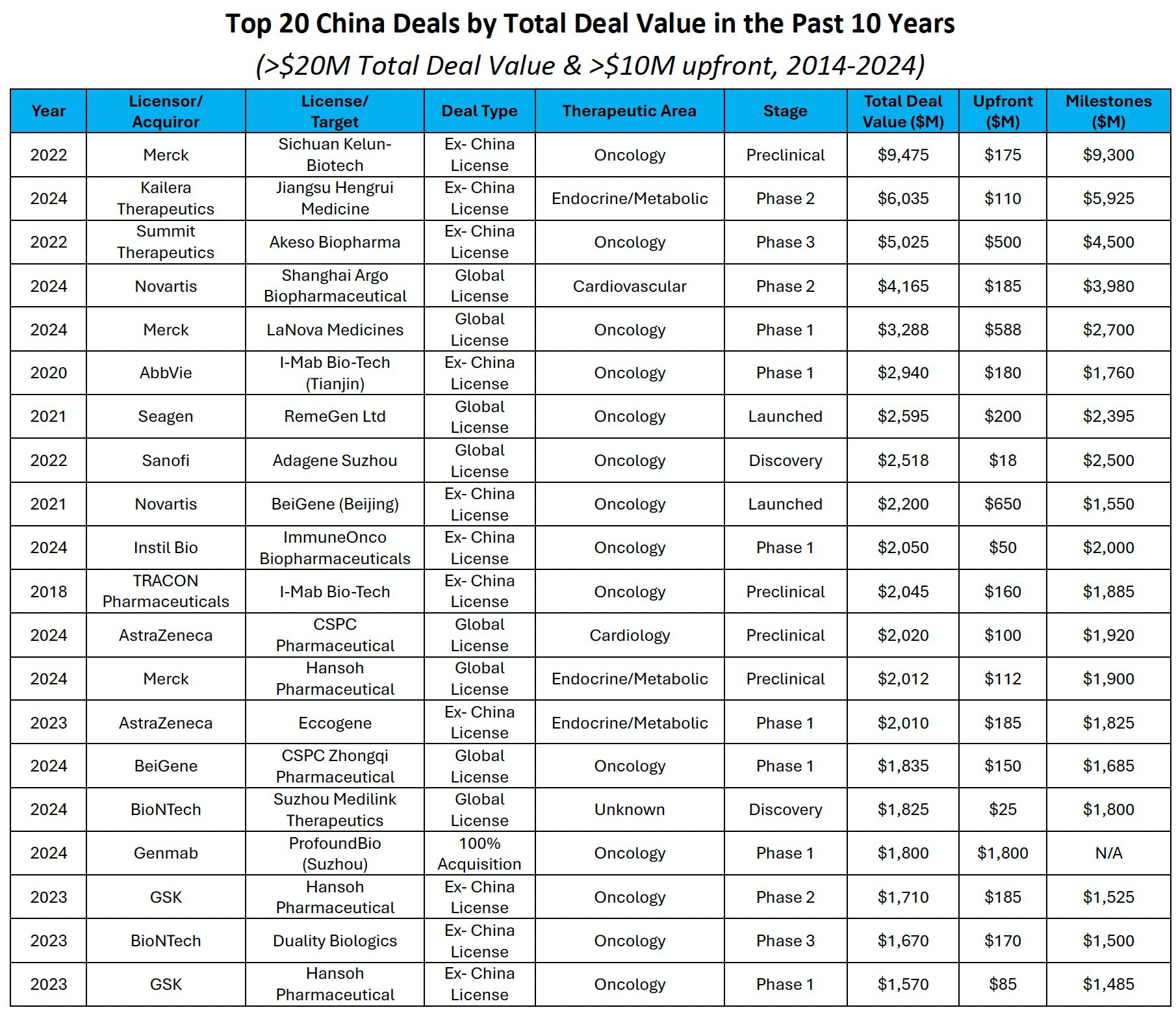

Since 2018, 23 deals have totaled more than $1.5B in total deal value (Table 1). Large pharma has accounted for more than 65% of those deals, electing to primarily in-license clinical-stage Chinese assets. Large licensing deals have been highly structured, with companies paying a mere 8% upfront for ex-China or global rights to clinical-stage assets. Preclinical deals with total deal values of greater than $1.5B have commanded broadly similar 5% upfronts, suggesting that the value of Chinese clinical data still remains uncertain. To date, Merck has conducted the largest deal, worth up to ~$9.4B ($175M, 2.5% upfront), when it announced a license and collaboration agreement for seven preclinical antibody-drug conjugates (ADCs) with Kelun-Biotech in 2022. In this same year, Summit Therapeutics announced their now infamous deal to develop and commercialize Akeso's AK-112 (Ivonescimab) in select ex-China geographies for $500M upfront (10% of total deal value) and ~$5B in milestones, with the asset in Phase 3 at the time of the deal. In the coming years, favorable data readouts from US clinical studies of late-stage Chinese assets (i.e., Summit’s HARMONi and HARMONi-3 Phase 3 studies) will likely significantly increase upfront premiums for clinically de-risked Chinese assets.

TABLE 1

Deal Structure

Within the Chinese dealmaking landscape, 60% of all deals included ex-China or global rights, with the most frequent deal type (~40%) involving licensing agreements for ex-China rights to assets (Figure 2). This signals a desire to further develop the local ecosystem, as 85% of licensors for China-only rights emanated from companies that are based in China. This past year also saw an increase in M&A deals for Chinese companies, with Genmab and BioNTech acquiring ProfoundBio and Biotheus for $1.8B and $950M, respectively.

FIGURE 2

Deal Modality

Since 2020, there has been a clear increase in Chinese biotech deals involving advanced modalities such as ADCs, cell therapies, and bispecific antibodies (Figure 3).

For example, Oakland’s Aditum Bio and Nanjing’s Leads Biolabs collaborated to form Oblenio Bio, which obtained worldwide rights to LBL-051, a first-in-class preclinical tri-specific T-cell engager for autoimmune disorders. Total deal terms summed to $614M, including $35M upfront. Though a domestic deal, 2024 also saw Shanghai JMT-Bio purchase rights to develop and commercialize Jiangsu Alphamab Biopharmaceuticals’ JSKN-003 in mainland China for $55M upfront. This asset is an anti-HER2 bispecific ADC (bis-ADC) currently in Phase 3 for advanced solid tumors, with first-in-class potential as a next generation ADC approach, further demonstrating the technological capabilities of Chinese companies. Notably, 2024 saw the emergence of a number of deals for novel nucleic acid-based medicines. Novartis, for example, struck a global multi-program licensing deal with Shanghai Argo for Phase 1 and Phase 2 RNAi programs targeting cardiovascular disease. They paid $185M upfront and offered up to $3.8B in milestones.

The emergence of China as an innovation hub did not happen overnight and is rather an accumulation of regulatory and policy changes throughout the past decade. In 2015, the Chinese National Medical Products Association (NMPA) introduced the Marketing Authorization Holder (MAH) system, a regulatory framework that allows for separation between the production and marketing rights of pharmaceuticals. This reform was officially implemented in 2019, enabling companies to outsource the production and manufacturing of their products to CDMOs, while retaining the rights to market them. Prior to this reform, only Chinese pharmaceutical companies with drug production licenses could hold marketing authorization for drugs. Eliminating this requirement for in-house manufacturing capabilities opened opportunities for biotech companies that lacked large-scale manufacturing resources to now commercialize novel therapies.

Further, China launched its own Breakthrough Therapy Designation (BTD) program in 2020, designed to expedite the development and approval process for therapies that treat serious or life-threatening conditions. This program, much like the ones in the US and EU, was a key driver in the increase of pharmaceutical innovation and likely the turning point that sparked the upward trend of deal activity, as it decreased the turnaround time for drug development and incentivized the development of novel mechanisms.

FIGURE 3

Deal Phase

With shortened timelines and reduced costs within Chinese clinical development, companies are predominately accessing Chinese-developed clinical and commercial stage assets. In the past 10 years, ~70% of assets were clinical stage or commercial at the time of transaction (Figure 4). The high number of clinical stage transactions is mainly attributed to a combination of a shortened investigational new drug (IND) review period and a sharp increase in the number of clinical trials occurring in China.

Indeed, the speed at which Chinese companies are progressing assets into the clinic is accelerating, with the average initiation period between new drug registration and trial initiation decreasing from 6.4 months to 3.8 months from 2019-2021[3]. There has also been an increase in the number of active clinical trial centers, which rose from 375 in 2015 to 1,072 in 20193. Furthermore, in 2019, China enacted a shortened IND review period, which reduced the review timeframe from 260 to 60 days, allowing companies to enter the clinic at a much faster pace. Such reforms continue at pace, and in August 2024, China launched a 1-year pilot program to further reduce the IND review to 30 days. The combination of a significantly decreased IND review period, a rapid increase in the number of clinical trial sites, and a population of over 1.4 billion people has afforded Chinese companies the ability to develop drugs at a rate not seen in the US.

In addition, companies are looking to China for drug development in a variety of indications. Historically, oncology drugs have dominated Chinese deal flow, but with the rising interest in metabolic and cardiovascular disease, companies have increasingly turned to China to fill their pipeline gaps.

FIGURE 4

Active Consolidators

The most active consolidators for Chinese assets are a “Who's Who” list of large pharma companies (Figure 5). Merck, in particular, has not shied away from Chinese acquisitions, with five deals totaling a combined value that is worth more than $17B (Figure 6). Three of those deals were with a single Chinese ADC partner, Kelun-Biotech. The end of 2024 saw Merck looking to China for innovation beyond just oncology, as the company paid $112M upfront and $1.9B in biobucks for Hansoh Pharma’s preclinical GLP-1 asset for obesity.

FIGURE 5

FIGURE 6

AstraZeneca has been the most active Chinese dealmaker, kicking off their deal-making in 2022, with a licensing agreement for global rights to Harbour BioMed's preclinical HBM-7022. All six of their deals were struck with six different Chinese companies across cell therapies, ADCs, bispecifics, and small molecules. Two deals had a total deal value of over $2B, with their largest upfront deal involving a $1.2B acquisition of China's Gracell Biotechnologies and their CAR T-cell therapy programs for both oncology and autoimmune indications.

Eli Lilly was an early mover in the US-China dealmaking space when, in 2015, they announced a licensing agreement with Innovent Biologics to develop and commercialize cancer therapies in China. While the cash-rich company has not conducted any relevant Chinese deals since 2021, Lilly does still appear committed to advancing their Chinese presence. In October 2024 they announced a $200M investment to expand their manufacturing site in Suzhou as well as a commitment to open a biotech incubator, dubbed “Lilly Gateway Labs,” in China.

FIGURE 7

The Chinese biotech ecosystem has a number of active players, with 71 unique companies engaging in 93 deals with >$10M upfront payments in the past 10 years. Most companies with multiple deals have focused on clinical-stage assets, which comprise 57% of the transactions shown in the above graph. Jiangsu Hengrui leads in deal activity, with the company primarily involved in Phase 1 ex-China licensing deals. Prior to 2024, all of Jiangsu Hengrui’s relevant deals had been for oncology assets. However, in May 2024, they out-licensed ex-China rights to three obesity assets to newly emerged Kailera Therapeutics for $110M upfront and ~$5.9B in milestones. Duality Biologics has also been an active ADC player with two ex-China licensing deals potentially worth >$1B. Duality’s deals included a preclinical agreement with GSK for $30M upfront and $975M in milestones, and a deal with BioNTech for $170M upfront and $1.5B in milestones for a Phase 3 (Phase 2 in the US) and preclinical ADC.

The Role of US Venture Capitalists

The interest in Chinese R&D is not exclusive to the realm of global biopharma, as a number of US VCs have committed to building companies solely based on Chinese assets. For example, at the time of their deal with Jiangsu Hengrui, Kailera Therapeutics had emerged from stealth mode with $400M of backing from notable US VCs (i.e., Bain Capital Life Sciences, RTW Investments, Atlas Venture, and Lyra Capital). The most advanced drug acquired in the deal was an oral GLP-1 agonist in Phase 2 development solely in China. This trend continued in January 2025, with Verdiva Bio emerging from stealth mode with $411M with backing from well-known investors, including Forbion, RA Capital, OrbiMed, General Atlantic, and others. The company had developed its pipeline solely from in-licensing drugs from China-based Sciwind Biosciences for undisclosed terms. Additionally, earlier in January 2025, Candid licensed a trispecific T- cell engager from WuXi Bio for up to $925M, and Avenzo paid $50M upfront for ex-China rights to DualityBio’s preclinical EGFRxHER3 bispecific. If this trend of US VCs backing companies based solely on Chinese assets continues, it may be very difficult for early-stage, US-based drug developers to gain a foothold in an already challenging fundraising environment.

A Future Outlook

China dominated biotech headlines in 2024 between the BIOSECURE ACT and an unprecedented amount of deal flow. While early, headlines involving China deals have already populated the industry news in 2025. Arguably, a major catalyst will come in December 2025 with the completion of Summit’s Phase 3 HARMONi study, and in December 2027, when Summit completes its head-to-head study against Keytruda (HARMONi-3). All eyes will be watching to see if Summit’s data will hold up when replicated in a larger trial outside China. A positive readout from the HARMONi studies would likely add even more fuel to Chinese deals, while a negative readout could be a speed bump to the clinical stage deal flow. Nevertheless, we note that approximately 32% of the 2024 deal flow was for preclinical assets and, therefore, likely immune to any readthrough from this highly anticipated trial. Further, we note the early saber-rattling from the policy front[4], as many fear that biotech R&D could quickly follow the semiconductor or EV industries, where Chinese companies lead in innovation relative to their US counterparts.

References:

Citeline. (2024). Pharma R&D Annual Review. https://www.citeline.com/-/media/citeline/resources/pdf/white-paper_annual-pharma-rd-review-2024.pdf

Stifel Biopharmaceutical Outlook for 2025

Zhang J, Zhang P, Wang H, Dong R. Changes in Early-Phase Clinical Trials in China During 2013-2022: A Review. Drugs R D. 2024 Sep;24(3):383-390.

We Must Win The Race For Global Biotech Innovation https://www.forbes.com/sites/gebai/2024/10/14/how-to-win-the-biotech-innovation-race-against-china/